Policy Updates for Kentucky, Ohio, and Indiana

Policy Updates

Below is a regional overview of Kentucky, Ohio, and Indiana’s policy updates related to economic development and how they may impact your business.

Kentucky gets aggressive with economic development program improvements; Ohio’s operating budget bill continues a strong economic development focus, and Indiana takes big steps back to retain and attract companies through its economic development program.

Kentucky

The Kentucky General Assembly’s 2025 session delivered a set of measured but meaningful policy updates across a range of housing, infrastructure, and economic development policies. Rather than launching large-scale new initiatives, lawmakers focused on refining core programs, improving access to infrastructure funding, and expanding tools that local governments and private developers use to unlock growth. With changes to manufactured housing policy, expanded access to Industrial Revenue Bonds, and targeted incentive updates for sectors like agriculture, tourism, and film, the state continues to support both rural and urban communities as they compete for jobs and investment.

Overview of Kentucky’s latest legislative changes and how they may support your local economic development priorities:

Housing and Community Development Programs

Kentucky addressed housing access and infrastructure needs through updated funding tools and regulatory consistency.

- Requires local governments to treat qualifying manufactured housing the same as single-family homes under local zoning laws.

- Expands the GRANT infrastructure program, improving access to matching funds for local projects tied to housing and site readiness.

Site Development and Incentive Policy

Lawmakers refined core programs to support redevelopment, rural investment, and industry-specific growth.

- Updates TIF program size and structure requirements to allow for more flexible applications across project types.

- Expands entertainment district incentives in Louisville and Lexington to encourage reinvestment in underused commercial areas.

- Broadens eligibility under the Tourism Development Act to include lodging and recreation-focused projects in areas such as Red River Gorge.

- Establishes a new Agricultural Economic Development Program to support locally led, income-generating projects in the ag sector.

- Limits foreign entities tied to certain governments from acquiring agricultural land in Kentucky.

Tax Policy Updates and Land Use Changes

Tax incentives and zoning updates aim to remove common development barriers and attract investment to targeted sectors.

- Creates the Kentucky Film Office and Film Leadership Council to centralize state support for film productions.

- Authorizes up to $75 million in annual tax credits for qualifying film and media projects.

- Expands eligibility for IRBs to include large-scale multifamily housing projects (48+ units).

- Limits zoning and planning appeals to adjacent property owners, reducing litigation risk and development delays.

Infrastructure and Community Investment

Kentucky offers advanced infrastructure access and services that support long-term community growth.

- Creates the Local Access Road Program (LARP) for local governments and removes the need for a local match.

- Expands services and communication tools for youth aging out of foster care through the Cabinet for Health and Family Services.

- Allocates $5 million to the Agricultural Economic Development Fund to support job creation and land productivity in rural communities.

Kentucky offers a large array of economic development programs designed to address the retention and attraction of companies to the Bluegrass State.

Ohio

Ohio Governor Mike DeWine and the Ohio General Assembly continued Ohio’s push to promote the creation of high-wage jobs and capital investments by promoting the state’s economic development. Efforts included in the recently enacted state of Ohio operating budget include reducing the tax burden on Ohioans, providing regulatory relief to industry, providing an enhanced focus on addressing the national housing crisis, and funding critical state economic development programs.

State of Ohio Tax Policy Changes

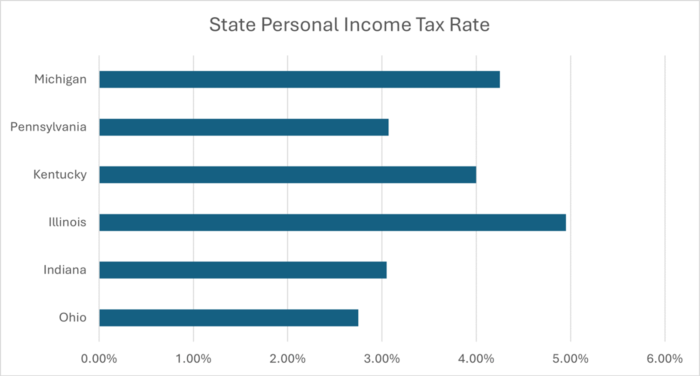

Ohio moved to a flat state income tax of 2.75% that provides a tax cut of over one billion dollars for Ohio taxpayers and positions Ohio as having the lowest personal income tax rates in the Great Lakes region.

Regulatory Relief

In a major move to support more local economic development, the Ohio General Assembly increased the local referendum threshold for voter signature requirements to 35% of those that voted in the last Governor’s election in a township, Home Rule Township, and statutory city, whose previous signature requirements were 15%, 15% and 10% respectively. Also, the Ohio General Assembly banned referendums against local governments at a mega-site project.

Local Economic Development Program Changes

The Ohio General Assembly made changes to how local government economic development programs operate, including:

- Allows a county, municipality, or home rule township to amend an existing community reinvestment area agreement to extend the term of the tax exemption to a total of 30 years for an existing building that is expected to be the site of a megaproject, allows a building to qualify for a CRA tax exemption as part of a megaproject so long as it is owned or occupied, as opposed to owned and occupied, by a megaproject operator or supplier, and establishes that a political subdivision that does not own the property subject to a CRA exemption, with an obligation to pay property taxes on that building, is not a required party to an agreement required for commercial CRA property tax exemptions.

- Modifies the New Community Organization Law to ensure limited home rule townships in large counties have additional autonomy to undertake economic development.

- Exempts regional transit authorities from the bill’s eminent domain restrictions, which maintain current law for RTAs, while maintaining the bill’s provisions for other subdivisions, including not permitting other local governments to use eminent domain for trail development.

- Allows cities and townships to increase resort area taxes up to 2.5% subject to voter approval (currently, taxes up to 1.5% cap are enacted without voter approval).

- Allows a board of commissioners, inside a designated resort area, to increase their lodging tax by 1% for public safety needs.

- Prohibits port authorities from entering into agreements for non-public entities that allow the private party to benefit from the sales tax exemption on construction materials without first obtaining county commissioner approval, if the project is located outside the port authority’s territorial jurisdiction, and excludes construction contracts between port authorities and private entities from the sales tax exemption for construction materials purchased for government buildings if the required approval has not been obtained.

Ohio’s Housing Programs

The Ohio General Assembly continued efforts to address the national housing crisis’s impact on the Buckeye State through the creation of a few programs, including:

- $25M the Residential Economic Development District Grant Program (REDD) to provide grants to political subdivisions that adopt pro-housing policies related to large-scale workforce housing, and revised criteria to incentivize projects with flexible zoning requirements, and adds regional planning commissions to the list of entities that may partner with subdivisions to apply for grants.

- Moving $100M for the General Residential Development Revolving Loan Program to $100, specially designed for infrastructure funding to support residential development in rural markets.

- Maintains the Ohio Housing Finance Agency as an independent entity.

- Modifies the Welcome Home Ohio tax credit criteria to increase the marketability of the credits.

Ohio Economic Development Programs

The Ohio General Assembly made changes to the state’s economic development program run primarily out of the Ohio Department of Development, including:

- Provides $200M in funding for the Ohio Brownfield Redevelopment Program and broadens who can apply for funding and what program funds can be spent on.

- Expands the purpose of the Roadwork Development and Facilities Establishment Funds for developments associated with tourism and sports attractions, but does not permit these funds to be used for retail facilities

- Creates a billion-dollar sports facilities fund to support the planned Cleveland Browns development in Brook Park and other sports facilities across the state through the one-time use of a portion of the state’s Unclaimed Funds Account

- Doubles the annual Opportunity Zone tax credit cap to $50M per FY and modifies the Ohio Opportunity Zone Investment Income Tax Credit to limit the total amount issued for a single project to $5M.

- Sets the annual Film and Theater Production tax credit cap at $50M per FY, allows an applicant for the Film and Theater Tax Credit to use an investment intent letter as documentation demonstrating that they have secured required funding, and adds companies that present Broadway performances as eligible applicants for the Film and Theater Tax Credit in addition to the current eligibility for producing companies.

- Sets the annual Historic Rehabilitation tax credit cap at $60M per fiscal year, prohibits ODOD from using building vacancy or underutilization as part of the criteria for awarding historic rehabilitation tax credits, and increases the percentage of rehabilitation costs a certificate owner may claim as a credit from 25% to 35% for a project that is not located in a municipality with a population of at least 300,000.

- Reauthorizes the Transformation Mixed Use Development (TMUD) tax credit cap to $150M per FY, makes substantial changes to the award criteria to emphasize projects with local support and projected economic benefit, requires that only the property owner can apply for the credit, and requires cost estimates to be submitted with an application for the credit.

- Clarifies that the statutory frameworks of the Ohio Opportunity Zone, Film & Theater, Historic Rehabilitation, and TMUD tax credit programs remain in permanent law, but issuance of new credits are subject to authorization by the General Assembly each fiscal biennium ensuring tax credit recipients will have the stability of the program to claim their credits while giving future General Assemblies better oversight of tax expenditures.

- Ohio’s Rural Industrial Loan Program is reduced to $2,500,000 annually in funding.

The General Assembly eliminated the data center sales tax exemption, but overall, the state of Ohio’s operating budget was supportive of the state’s continued effort to succeed in a challenged, global economy.

Indiana

Indiana’s 2025 legislative session brought notable policy shifts that reflect a new direction under Governor Mike Braun’s administration. Focused on delivering taxpayer relief while reshaping the state’s approach to economic development, lawmakers advanced several high-impact changes in tax policy, program oversight, and investment strategy. While some long-standing economic development programs were phased out due to budget constraints, Indiana is making targeted investments in areas such as infrastructure, advanced manufacturing, and emerging technologies. At the same time, reforms were introduced to improve transparency and accountability in the administration of state incentives. Below is a summary of recent policy developments in Indiana.

Property Tax Policy Changes

Indiana enacted broad reforms to reduce the property tax burden on businesses and homeowners, while creating new flexibility for local governments to manage the fiscal impact.

- The exemption threshold for business personal property was increased to $2 million per county, beginning in 2026, easing compliance for small and mid-sized firms.

- The state eliminated the 30% floor on equipment depreciation for newly acquired assets, except in TIF districts, where the floor remains to protect local revenue streams.

- A new deduction for properties taxed at the 2% rate, including rental and agricultural properties, will be phased in over several years, starting at 6% and increasing to one-third of the assessed value.

- All Indiana homeowners will receive a 10% property tax credit, capped at $300 annually, beginning in 2026.

- The homestead deduction system was revised to provide expanded relief, with adjustments scheduled through 2031.

- New Childcare Facility Property Tax Exemption: Businesses operating an on-site licensed childcare facility for their employees’ children may be eligible for a partial property tax exemption, providing a valuable incentive for workforce support infrastructure.

- Re-establishment of Aircraft Property Deduction: restores a deduction for aircraft-related abatement property, allowing eligible taxpayers to deduct assessed value on qualifying aircraft assets for each year the property is subject to ad valorem taxes.

- Local jurisdictions have been granted authority to increase local income taxes or implement alternative revenue mechanisms to address potential budget gaps.

Indiana’s tax mix shifts away from property-based taxation and toward income-based taxation. Businesses may feel the effects of local government taking a big loss in property tax revenue, which will affect how local government is run and the services it provides.

Restructuring of Economic Development Programs

Considering projected budget limitations, the state scaled back several economic development initiatives while advancing sector-specific tools to support innovation and long-term competitiveness.

- Funding was discontinued for multiple long-running programs, including the Manufacturing Readiness Grants, Skills Enhancement Fund, Economic Development Fund, Industrial Development Grant Fund, and Direct Flight Establishment Fund.

- Deal Closing Fund – only $1/year, but can be increased by the Budget Committee if tied to a project within an Innovation Development District (IDD)

- A 20% tax credit was created for companies involved in manufacturing small modular nuclear reactors, supporting Indiana’s position in the advanced energy sector.

- New incentives were introduced for emerging fields such as quantum computing and defense-aligned infrastructure investment.

- Updates to the Film and Media Production Tax Credit allow credits to be transferred to other taxpayers, increasing their flexibility and usability.

- A new tax credit for freight rail infrastructure was also established to support logistics investment.

- Funded Workforce Innovation (Next Level Jobs and Workforce Ready Grants) – $18 million/year

Governance, Transparency, and Oversight

Lawmakers advanced reforms to ensure stronger oversight of economic development activity and improve public trust in how incentives are deployed.

- The Indiana Economic Development Corporation’s (IEDC) tax credit cap was increased to $300 million per year, the Historic Rehabilitation Tax Credit is now included in this cap, while the minimum investment required for large-scale project zones was lowered from $2 billion to $750 million.

- Program administration for Certified Technology Parks was moved under a newly created Office of Entrepreneurship and Innovation (new), created to support entrepreneurial growth and innovation.

- IEDC is now required to publicly disclose land acquisitions over 100 acres at least 30 days in advance, and members of the state budget committee must be invited to project site tours tied to state funding.

- The Governor ordered an independent audit of IEDC and its affiliated entities to reinforce fiscal transparency and performance accountability.

Infrastructure and Site Readiness

Despite the elimination of some direct grant programs, Indiana preserved support for infrastructure development through targeted updates to existing tools.

- The Community Crossings Matching Grant Program was revised to improve how local governments access state road funding.

- A new Railroad Infrastructure Tax Credit was introduced to incentivize investment in freight logistics and rail access improvements.

- While fewer individual grants will be awarded, the state’s increased project thresholds and specialized credits position Indiana to compete for larger-scale investments.

Of greater concern for the Hoosier State is the battle between the leadership of the state and the Indiana Economic Development Corporation, which leads the state’s economic development efforts. IEDC is facing a state freeze in funding, an audit of its operations, and litigation related to its activities. It is tough to retain and attract companies to a state when the organization on point for the effort is under siege.

Position Your Business for What’s Next

As Kentucky refines its incentive toolkit, Ohio doubles down on its push to promote the creation of high-wage jobs and capital investments, addresses the housing crisis, and Indiana reshapes its economic development strategy under new leadership, one thing is clear: the rules of the game are changing—and fast. For companies evaluating where to grow, invest, or relocate, understanding these shifts isn’t optional—it’s essential.

At Ashmore Consulting, we specialize in helping businesses decode complex state and local policy changes and translate them into strategic advantage. Whether you’re navigating tax credit eligibility, evaluating infrastructure readiness, or aligning with the right local partners, we bring the insight, local relationships, and experience to guide your next move with confidence.

Let’s talk about how these changes impact your site selection strategy.

Schedule a consultation, connect with us on LinkedIn, or message us through our business page.

The information contained herein is general in nature and is not intended and should not be construed as legal, accounting, or tax advice or opinion provided by Ashmore Consulting LLC to the reader. The reader is also cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances or needs and may require consideration of non-tax and other tax factors if any action is to be contemplated. The reader should contact Ashmore Consulting LLC or another tax professional prior to taking any action based upon this information. Ashmore Consulting LLC assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein.

Follow Us

Follow Us

Ashmore Consulting is proud to join Pledge 1%, a global movement creating new normal where companies of all sizes integrate giving back into their culture and values. Pledge 1% empowers companies to donate 1% of product, 1% of equity, 1% of profit or 1% of employee time to causes of their choice. Over 1,500 companies in 40 countries have taken the Pledge and committed to give to communities around the world. Ashmore Consulting is excited to join Pledge 1%’s network of founders, entrepreneurs and companies around the globe that have committed to giving back.

Ashmore Consulting is proud to join Pledge 1%, a global movement creating new normal where companies of all sizes integrate giving back into their culture and values. Pledge 1% empowers companies to donate 1% of product, 1% of equity, 1% of profit or 1% of employee time to causes of their choice. Over 1,500 companies in 40 countries have taken the Pledge and committed to give to communities around the world. Ashmore Consulting is excited to join Pledge 1%’s network of founders, entrepreneurs and companies around the globe that have committed to giving back.