Opportunity Zone 2.0 Is Here

Opportunity Zone 2.0 Is Here: A New Era of Permanent Tax Incentives and Rural Investment

On July 4, 2025, President Trump signed the “One Big Beautiful Bill” (H.R. 1) into law, and with his signature, the Opportunity Zone (OZ) program became a permanent fixture in the federal tax code, ushering in a new era commonly referred to as “OZ 2.0.”

The Opportunity Zone program, created in 2017, is designed to spur economic growth and job creation in low-income communities while providing tax benefits to investors. Opportunity Zones are federally certified census tracts, Qualified Opportunity Zone property, which are eligible for investments by Qualified Opportunity Zone Funds from capital gains revenue. The Opportunity Zone program provides three tax benefits for investing unrealized capital gains in Opportunity Zones:

- Temporary deferral of taxes on previously earned capital gains. Investors can place existing assets with accumulated capital gains into Opportunity Funds. Those existing capital gains are not taxed until the end of 2026 or when the asset is disposed of.

- Basis step-up of previously earned capital gains invested. For capital gains placed in Opportunity Funds for at least 5 years, investors’ basis on the original investment increases by 10 percent. If invested for at least 7 years, investors’ basis on the original investment increases by 15 percent.

- Permanent exclusion of taxable income on new gains. For investments held for at least 10 years, investors pay no taxes on any capital gains produced through their investment in Opportunity Funds (the investment vehicle that invests in Opportunity Zones).

Whether you’re a fund manager, investor, developer, or policymaker, here are the key OZ 2.0 reforms now in effect that you need to know:

Permanent Status

OZ incentives are no longer set to expire. They are now a permanent part of the Internal Revenue Code, ending years of uncertainty about the program’s future.

Rolling 5-Year Gain Deferral

Under OZ 2.0, any qualifying capital gain invested into a Qualified Opportunity Fund (QOF) on or after January 1, 2027, will be deferred for exactly five years from the date of that investment. This is a shift away from the original OZ structure, where all deferred gains had to be recognized by December 31, 2026, regardless of when the investment was made. That older model created a “sunset cliff” for tax deferral.

Now, with the new rolling deferral, the clock starts when the investment is made — not based on a fixed program end date. For example:

- If you invest a capital gain into a QOF on March 1, 2027, that gain will be deferred until March 1, 2032, or until the investment is sold — whichever comes first.

- If you invest in June 2028, the gain is deferred until June 2033, unless sold sooner.

New Basis Step-Up Schedule

Standard QOF Investors (investing in any qualifying zone):

-

- Receive a 10% step-up in basis after 5 years of holding their investment.

- This means 10% of the original deferred capital gain is excluded from taxation when the gain is eventually recognized.

- Rural QOF Investors (investing through a fund that focuses on designated rural OZ tracts):

- Receive a 30% step-up in basis after 5 years.

- In other words, they can permanently exclude 30% of their deferred gain from tax — a 3× benefit compared to standard zones.

| Feature | Original OZ Program | OZ 2.0 (Starting in 2027) |

| Step-up Timing | 10% after 5 years, an additional 5% after 7 years | Flat 10% after 5 years (standard), 30% for rural |

| Max Step-Up | 15% total if invested before 2019 | 10% (standard) or 30% (rural) |

| Deadline Pressure | Had to invest by the end of 2019 for the full benefit | No deadline — step-up is based on holding period only |

| Rural Preference | No distinction between rural and urban zones | Strong rural-specific incentive with enhanced benefits |

Rural Incentives Boosted

Rural OZs (outside cities/towns of 50,000+) now only need to meet a 50% substantial improvement test, instead of the usual 100%, and at least 33% of new OZ designations in 2027 must be in rural areas.

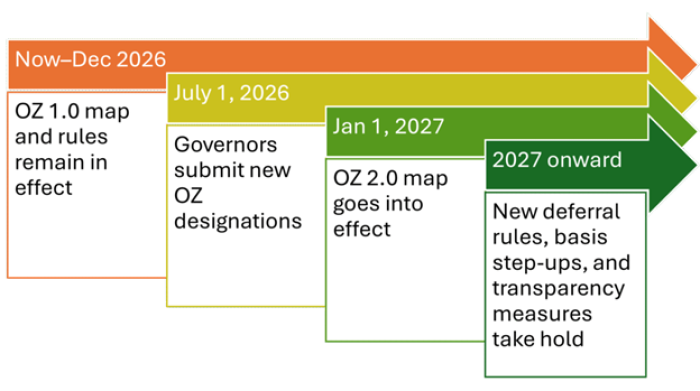

Zone Redesignation

Current Opportunity Zones will need to be redesignated. The next Opportunity Zone designation cycle will begin on July 1, 2026, when governors will begin nominating a new map of census tracts. Once the Secretary of the Treasury certifies those tracts, the new map of Opportunity Zones will go into effect on January 1, 2027, and last for 10 years, after which it will be replaced with updated designations on a decennial basis. The current OZ map will remain in effect through the end of 2028, meaning that it will overlap with the new round of designations for two years. As was the case in the original OZ statute, governors may select up to 25 percent of their states’ eligible tracts, with a 25-tract minimum. Importantly, governors maintain full discretion when nominating tracts for OZ status. Opportunity Zone 2.0 used the same “low-income communities” definition for eligibility that was established in the New Markets Tax Credit (NMTC) program, but imposes new, stricter criteria for OZ eligibility. For future rounds of designation, a census tract will need to satisfy one of the following tests:

- Median family income (MFI) below 70 percent of the state (non-metro) or metro (metro areas) median (versus 80 percent in the original OZ provision).

- Poverty rate of 20 percent or greater (unchanged), plus a newly-established MFI cap set at 125 percent of the applicable state or metro median. The MFI cap closes a statistical loophole that allowed a small number of high-income census tracts to qualify for OZ status.

The contiguous tract rule has been eliminated—this limits inclusion of high-income areas adjacent to qualifying zones. Under the original OZ legislation (OZ 1.0), states were allowed to designate a limited number of higher-income census tracts as Opportunity Zones if they were directly adjacent (contiguous) to qualifying low-income tracts. In practice, this allowed some relatively affluent or rapidly gentrifying areas to be included in the OZ program. With OZ 2.0, tracts must individually meet eligibility standards; adjacency to a low-income area no longer counts. Puerto Rico loses its special blanket designation; now limited to selecting up to 25% of eligible tracts, like all other states.

According to the Economic Innovation Group, the stricter targeting criteria will not only result in a smaller map but also a more distressed one. The average OZ-eligible census tract has a poverty rate more than twice the national figure, compared to 1.68-times for Opportunity Zone 2.0 designations. Similarly, the median family’s income in the average eligible tract is now only 59 percent of the national figure, compared to 65 percent before. The typical eligible tract is also more diverse now, paralleling the nation’s demographic evolution. Opportunity Zone 2.0 OZ designations were already more distressed across the board than the class of eligible low-income tracts generally; the OZ map going forward is likely to be even more targeted towards the neediest communities.

Transparency & Reporting Requirements

Enhanced reporting rules cleared Senate procedural hurdles and will apply beginning in tax year 2027. Funds and investors must provide greater disclosure of the following:

- Project-level investment data (where the money is going)

- Job creation numbers

- Affordable housing units (if applicable)

- Business outcomes – Growth in revenue, employment, and local sourcing for operating businesses receiving OZ funding.

- Community benefit indicators

Opportunity Zone 2.0 Timeline

Going forward, for investor OZs, are no longer a “closing window”—they’re now a permanent strategy, but timing still matters for maximizing gain deferral and step-ups. For developers, Rural OZs are a new frontier with enhanced incentives and more flexible investment rules, and for communities, the decade-based redesignation process could open doors for new areas to benefit, or risk losing status with local advocacy will be critical. Finally, for policymakers, the expanded transparency requirements address longstanding criticism and open the door for evidence-based refinement of the program.

Ready to Maximize Your Opportunity Zone Strategy?

The landscape of Opportunity Zones has changed—permanently. OZ 2.0 offers unprecedented potential for long-term tax savings, rural investment advantages, and strategic growth. But navigating the new rules, redesignation cycles, and incentive structures requires more than just awareness—it demands expertise.

If you‘re planning a new project, expanding operations, or repositioning assets, now is the time to act. Our team specializes in site selection advisory and incentive negotiation, helping clients secure optimal locations and unlock incentive packages that meet—and often exceed—their financial goals.

Let’s make your next move your smartest one yet.

Contact us today to schedule a confidential consultation and discover how we can help you leverage OZ 2.0 and other state and local incentives to drive lasting success.

Follow Us

Follow Us

Ashmore Consulting is proud to join Pledge 1%, a global movement creating new normal where companies of all sizes integrate giving back into their culture and values. Pledge 1% empowers companies to donate 1% of product, 1% of equity, 1% of profit or 1% of employee time to causes of their choice. Over 1,500 companies in 40 countries have taken the Pledge and committed to give to communities around the world. Ashmore Consulting is excited to join Pledge 1%’s network of founders, entrepreneurs and companies around the globe that have committed to giving back.

Ashmore Consulting is proud to join Pledge 1%, a global movement creating new normal where companies of all sizes integrate giving back into their culture and values. Pledge 1% empowers companies to donate 1% of product, 1% of equity, 1% of profit or 1% of employee time to causes of their choice. Over 1,500 companies in 40 countries have taken the Pledge and committed to give to communities around the world. Ashmore Consulting is excited to join Pledge 1%’s network of founders, entrepreneurs and companies around the globe that have committed to giving back.